Introduction:

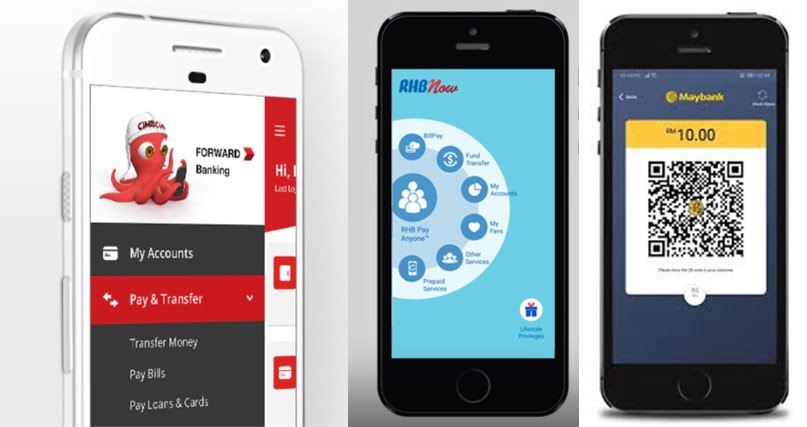

Mobile banking is a service that allows bank customers to do a range of financial transactions using their mobile phone or personal digital assistant. Mobile banking is distinct from mobile payments, which are similar to debit cards and involve using a mobile device to pay for products or services at the point of sale or remotely. Since I have mentioned the general info regarding mobile banking, thus let’s take a look at the ups and downsides of mobile online banking, shall we?

5

5

Upsides of Mobile Banking

- Limitless Access to Banking Services

To begin with, having the ability to make judgments is beneficial in any scenario, and mobile banking is no exception: With a few exceptions, such as regular maintenance updates and unanticipated outages, mobile banking allows you to select when you wish to access your account, unlike a bank branch. Finally, you will save time as a result of this convenience. Take mobile check deposit, for example, which is available in the majority of mobile banking apps. Customers can use a remote deposit to deposit a check from the convenience of their own home. Not only may mobile banking help you avoid in-person hazards, such as the pandemic-related health concerns that many of us are presently dealing with.

- Provides Additional Control

Aside from that, think of a mobile banking app as a remote control for your money. You may deposit a check and transfer money to anyone at any time using the app. These limitations are growing increasingly complex. For example, certain bank programmes allow you to activate a new credit or debit card. The bank’s default response when someone attempts to use a card that hasn’t been activated is to refuse the card. Bruhnke asserts. “Now, if you have the mobile app, you’ll get a push notification that says, ‘Hey, your card hasn’t been approved.’ ‘Would you like to activate that?'”

- Enhanced Security

Your bank may send you a code through text message if you make a money transaction that exceeds a certain amount. Some bank applications and mobile devices now allow you to log in by scanning your face. Mobile devices — and certain bank applications — now let you log in by scanning your face or fingerprint as another way to protect your digital bank account without losing convenience. If you’re concerned about the security of your mobile banking account, there are steps you can do to improve security.

Downsides of Mobile Banking

- Security Issues

Furthermore, existing bank-specific applications have several security issues, ranging from data leakage to insufficient data encryption. Hackers may be able to acquire access to your data. To avoid being a victim of fraud, don’t give anyone your password or other billing information. If you lose your smartphone, it’s always conceivable that hackers may gain access to your bank account.

- Compatibility problems

Finally, but certainly not least. Not every smartphone model is compatible with every app. Furthermore, your device might not be compatible with the platform for which an app was created. Mobile banking is frequently limited to high-end phones. You’ll also need a reliable internet connection for your software to run smoothly and without delays.

Conclusion:

Mobile banking is undeniably handy in terms of client experience. However, because mobile banking has drawbacks, users should keep track of their assets and investments frequently. If you have any questions about your banking service, you can always use internet banking services Malaysia for more information.